Using a homegrown Excel approach is a clear signal that modernization is needed

Versioning and data integrity risks

With 25 Excel files sent and modified in parallel, version tracking becomes almost impossible. Human errors or faulty copy-pastes can corrupt the data, slow consolidation, and lead to inconsistent results. Each iteration increases the risk of inaccuracies in the forecasts.

Security and confidentiality challenges

Excel does not easily allow restricting access to certain data sections without creating a separate file for each stakeholder. This increases management complexity and multiplies the number of files circulating within the organization. The risk of someone accessing sensitive information (salaries, confidential budgets, etc.) is very real.

Collaboration Difficulties and Lack of Traceability

Coordinating exchanges between 25 stakeholders via email or file sharing multiplies delays, makes tracking difficult, and prevents any real-time overview. It becomes nearly impossible to know who changed what and when, harming transparency and accountability.

Laborious Manual Consolidation

At the end of the process, the finance team often has to manually compile the 25 files to produce a consolidated version. This consumes valuable time, introduces errors, and delays strategic analysis. This manual work diverts financial analysts from higher-value tasks.

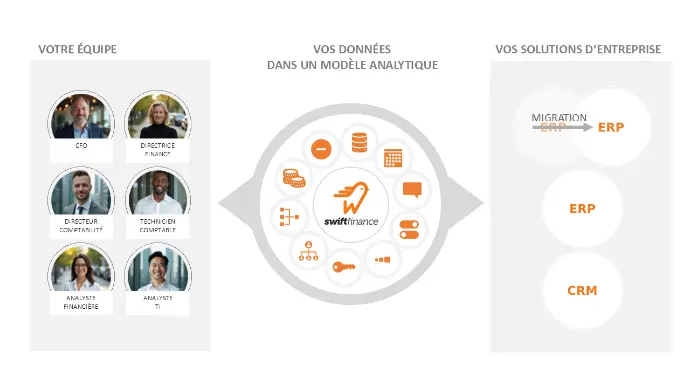

SEE HOW SWIFTFINANCE CAN HELP PEOPLE LIKE YOU

Finance Director,

Professional Services

We had reached the limit of what we could do with Excel. The ERP system was not flexible enough to support our planning needs, and customizing the system was too expensive.

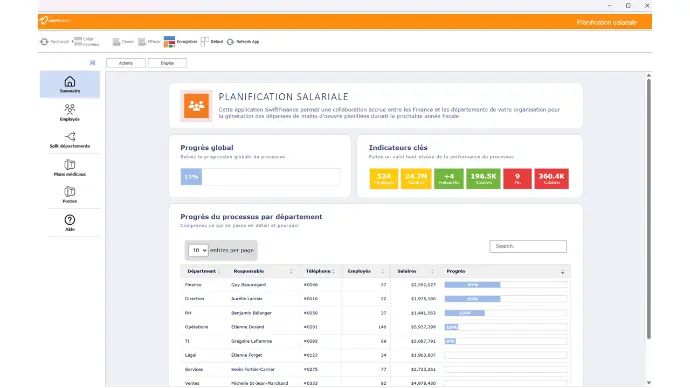

SwiftFinance allowed us to build specialized applications like salary planning and CAPEX directly within Excel, but in a secure, governed way, fully integrated with our centralized financial model.”

CFO,

Manufacturing

With over 20 managers involved in the budgeting process, managing everything through Excel was a nightmare. Versions got lost, numbers didn’t match, and we had no control over who was modifying what

Thanks to SwiftFinance, each user accesses only their section, validations are automated, and consolidation is instant. We’ve gained rigor and efficiency..

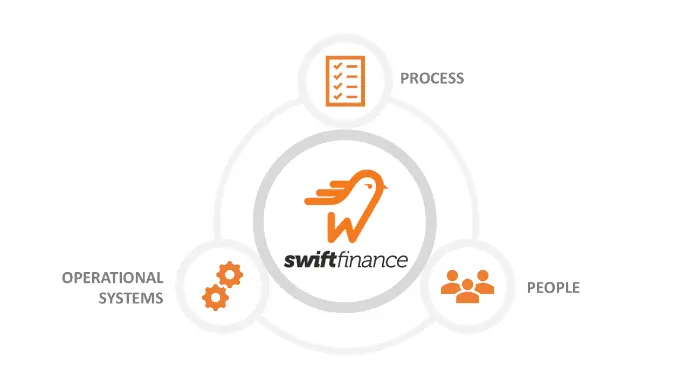

How Swiftfinance can help optimize

your budgeting process operations

Protect finance operations ⚫︎ Much more flexible reporting than any ERP ⚫︎ Capacity to support growth through acquisitions ⚫︎ Customized financial applications ⚫︎ Governance and compliance

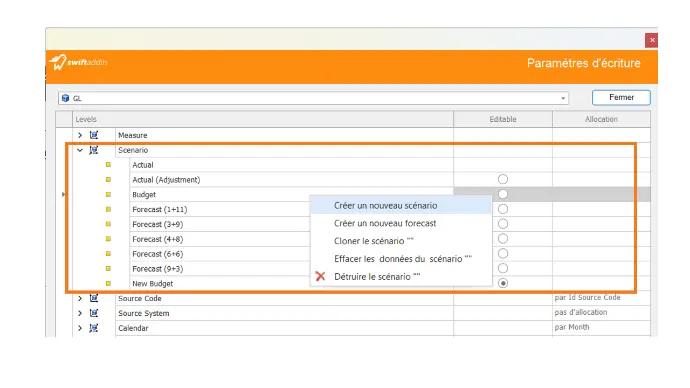

Full control over budget scenarios

SwiftFinance lets you define additional budget versions, manage write permissions, set allocation methods, and specify which measures are open for entry — ensuring complete control over how the writeback module is used within the centralized analytical financial model.

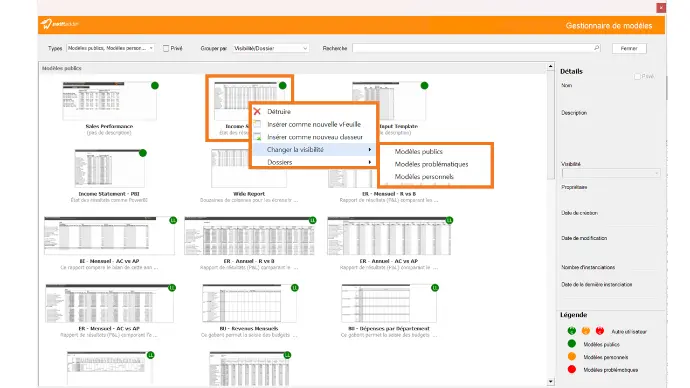

Centralized governance ensures compliance

SwiftFinance enables each contributor to work on their portion of the budget directly within Excel, using a familiar interface, while respecting confidentiality through integrated access rights. It also maintains a historical trace of all changes made to the data entered in the templates..