Centralize your financial information for

enhanced governance and security

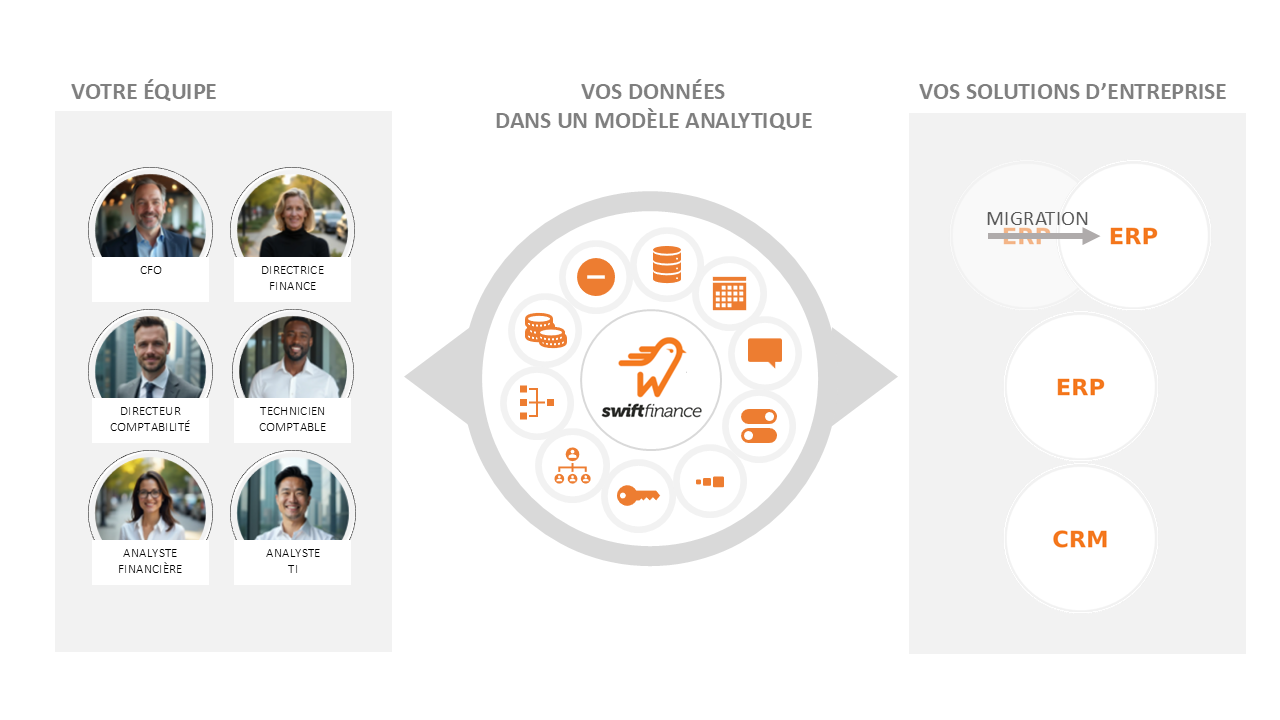

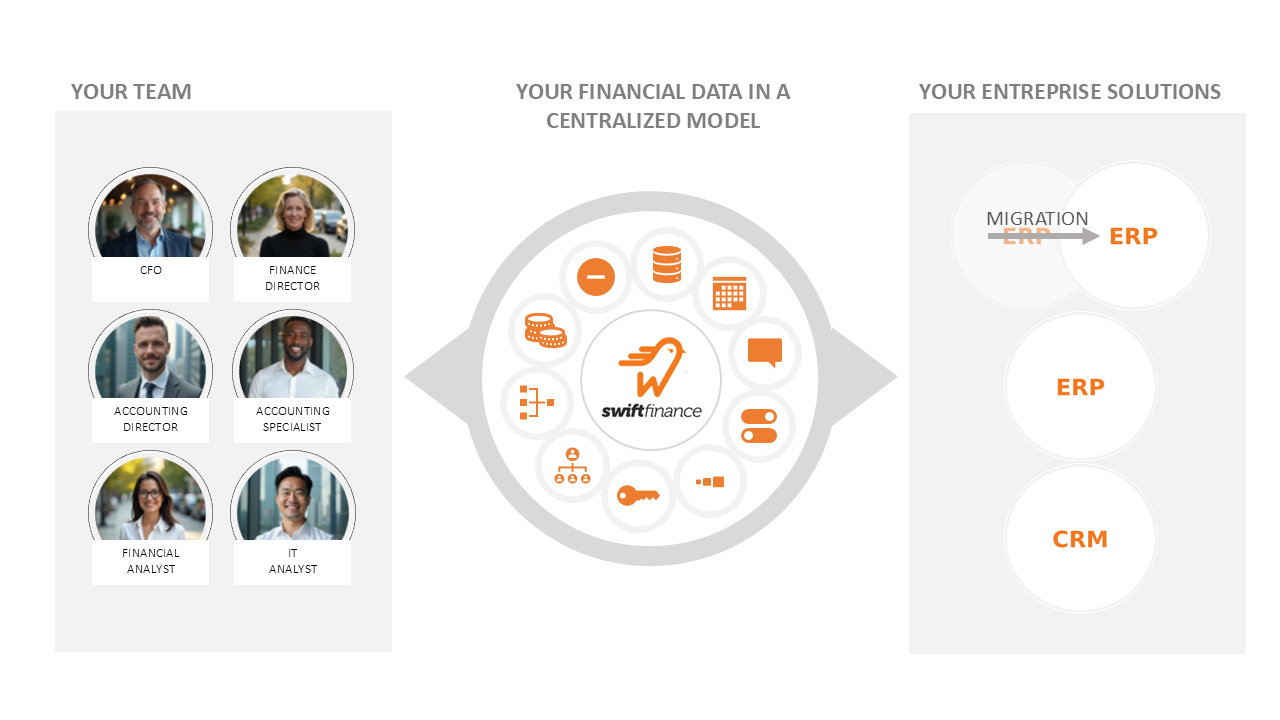

SEE HOW THE SWIFTFINANCE CENTRALIZED ANALYTICAL MODEL CAN HELP PEOPLE LIKE YOU

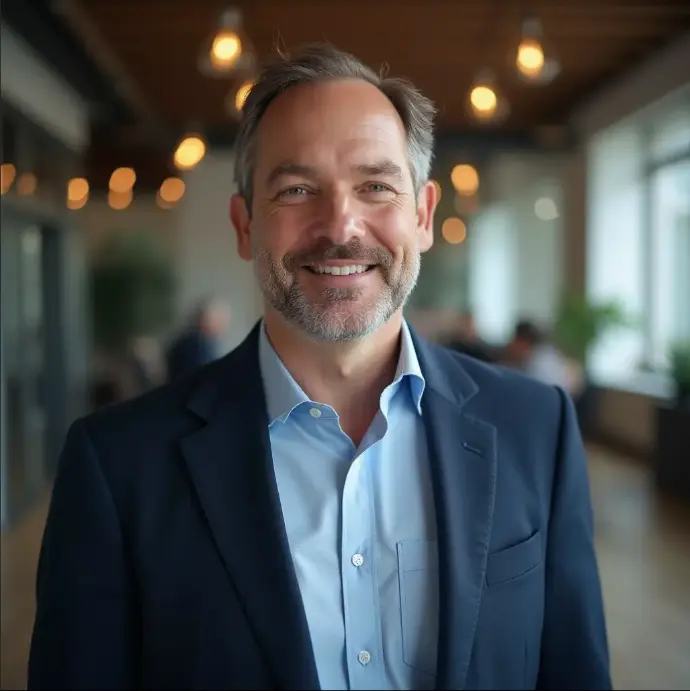

CFO

"Decoupling information from operational systems and centralizing it in an analytical financial model gives us greater flexibility.

I can now ensure enhanced governance and better security in managing our financial processes.

Finance Director

Centralizing information has allowed us to automate many operations that were previously manual.

It greatly simplifies how my team uses information, especially for financial reporting, consolidation, and budget production.

Features

The information you need is stored outside of operational systems and modeled in a flexible, secure format that offers powerful analytical capabilities..

SwiftFinance significantly enhances the capabilities of Microsoft Excel by effectively addressing challenges such as

- data duplicated across multiple Excel files

- the difficulty of modifying ERPs to adapt to organizational specificities

- limited control over manual operations performed on the data

- definitions and calculations being replicated in multiple places

- security risks associated with data stored in Excel files.

Chart of accounts ⚫︎ Cost centers ⚫︎ Multiple currencies ⚫︎ Fiscal calendars ⚫︎ Accounting key segments ⚫︎ Entry types ⚫︎ Scenarios⚫︎ Source systems ⚫︎ Fund accounting ⚫︎ Legal entities ⚫︎ Language

Accounts

The analytical financial model of SwiftFinance allows you to integrate all your accounts, their attributes, codifications, and multiple heterogeneous charters, whether from one or multiple ERP systems.

Cost Centers

SwiftFinance’s analytical financial model enables the integration of your cost center structure, allowing for detailed functional analysis within your organization.

Currencies

SwiftFinance’s analytical financial model supports multiple currencies, enabling financial reporting in both local and consolidated currencies across the organization.

Calendars

SwiftFinance analytical financial model supports complex fiscal calendars tailored to your specific context, including 4- or 5-week periods and fiscal years with 12 or 13 periods.

Segments

SwiftFinance’s analytical financial model integrates all segments of your accounting key to support reporting tailored to your organization's unique structure

Entry types

The model enables reporting by transaction type—including corrections, closing entries, and opening balances—offering greater detail, clarity, and end-to-end traceability in financial reporting.

Scenarios

Le modèle analytique financier de SwiftFinance’s analytical financial model supports integration of actuals as well as all budget and forecast scenarios, enabling detailed comparisons aligned with your organizational needs.

ERP (Sources)

SwiftFinance ensures full traceability of data origin and all transformations applied, maintaining complete transparency and auditability..

Fund accounting

SwiftFinance includes full support for fund accounting, widely used in municipal and public sector contexts. For example, the analytical model’s custom totals feature allows you to integrate the standard chart of accounts recommended by the rugulatory bodies without modifying the client’s existing one.

Legal entities

SwiftFinance's analytical financial model enables consolidation across multiple legal entities, including elimination entities, with reporting available at every level.

Languages

SwiftFinance’s analytical financial model allows reporting in multiple languages, addressing the complexities of multilingual financial reporting.

STILL MANAGING YOUR DATA IN EXCEL?

Request a short interactive demo to see the benefits of storing them in a centralized and secure model outside of Excel files.

YOU MIGHT ALSO BE INTERESTED IN THESE ARTICLES