Extending the life of an outdated ERP for Finance needs

A SWIFTFINANCE REAL LIFE CASE STUDY

Being stuck with an outdated ERP is a significant obstacle to organizational growth

Limited or slow access to financial data

Outdated ERP systems make data extraction slow, inflexible, or require a heavy reliance on IT. This hinders the finance department's ability to quickly produce reliable reports, perform accurate analyses, or respond to management requests.

General lack of flexibility to adapt

Increasingly, financial processes are being performed manually outside of the ERP using Microsoft Excel, requiring additional resources to complete them. The proliferation of in-house Microsoft Excel tools is widespread, unsecured, and untraceable.

Inability to sustain growth

An outdated ERP often becomes a hindrance as a company grows or makes acquisitions. It's difficult to add new entities, integrate different accounting plans, or manage new business structures. This complicates consolidation and group-wide forecasting, and slows down strategic decision-making.

Governance and consolidation issues

With multiple data sources, manual extractions, and heterogeneous tools, it becomes difficult to ensure complete traceability, access security, and consistent consolidation of entities or subsidiaries.

SEE HOW SWIFTFINANCE CAN HELP PEOPLE LIKE YOU

Finance Director, Manufacturing

Our ERP did not allow us to manage budgets by site and by product line without custom development.

Thanks to FP&A Swiftfinance, we were able to structure a multidimensional budget model, integrated with our existing data, without modifying the ERP. The time savings and error reduction were immediate.

Financial Director, Retail Sales

Consolidating our six entities was manual and took nearly two weeks each month. Developing this in our ERP was too costly.

With the FP&A solution, we were able to automate consolidation and apply custom conversion rules. This extended the life of our ERP without having to redo all our operational processes by migrating to a new ERP

How Swiftfinance can help you

to extend the life of your ERP

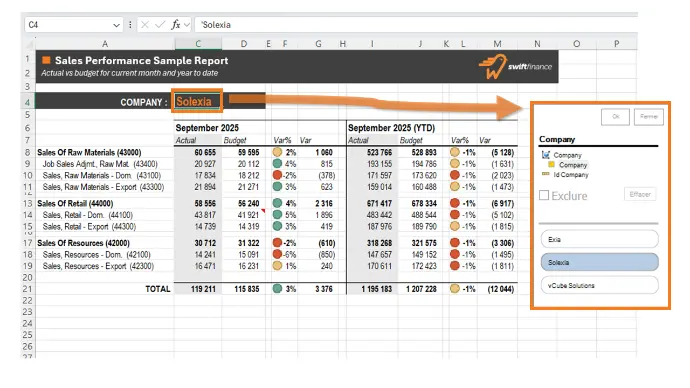

Protect Finance Operations ⚫︎ Much more flexible reporting than any ERP ⚫︎ The ability to support growth through acquisitions ⚫︎ Customized financial applications ⚫︎ Governance and compliance

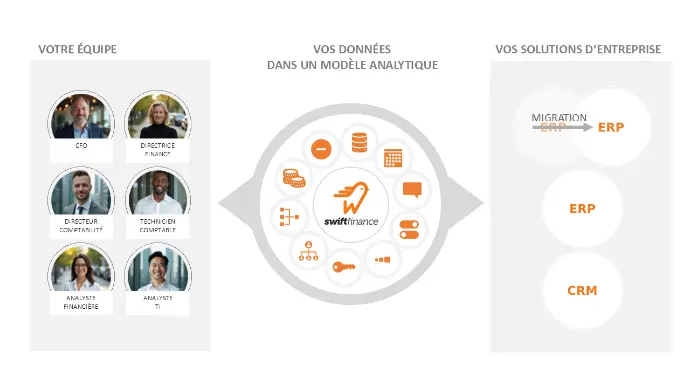

Protect the Finance function by decoupling it from the ERP

SwiftFinance offers a centralized financial model that decouples data and operations from most financial processes within the ERP. This also protects financial processes from the impacts of a potential future migration to a new, more powerful ERP, starting today.

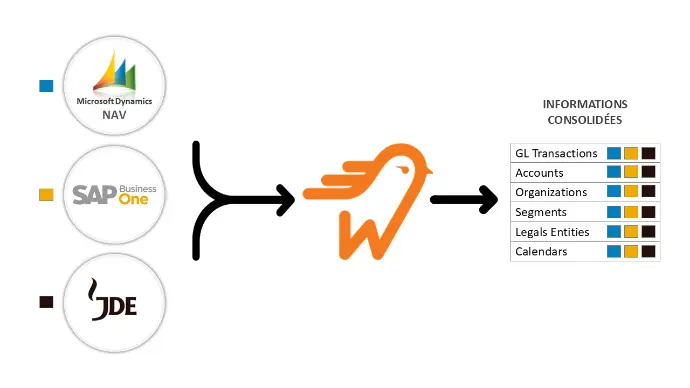

The ability to support growth through acquisition

SwiftFinance allows for the integration of financial data from multiple ERPs and the harmonization of charts of accounts, much more easily than ERPs. This allows the Finance group to continue supporting the organization's growth with much greater flexibility than if the consolidation were carried out in the ERPs.

Customized applications to overcome ERP operational deficiencies

SwiftFinance offers applications that allow you tocentrally and securely operate financial processes that are not supported by ERP and are currently managed in in-house Microsoft Excel applicationswithout governance and with questionable sustainability..