Why adopting SwiftFinance will transform your Finance department

SEE WHY IT'S IMPORTANT AND WHAT BENEFITS YOU CAN GET FROM IT

SwiftFinance abstracts financial processes from day-to-day operations to improve transparency, rigor and efficiency

SwiftFinance protects your finance operations and financial processes when changing operational solutions such as ERPs or when key people leave

Ensures the sustainability of operations

01

SwiftFinance enables centralized governance across all financial processes and reduces reliance on Excel-based operations

Brings more operational efficiency

02

SwiftFinance adapts much more easily to the specifics of your financial processes than operational solutions while offering the same flexibility as Microsoft Excel

Increases technological flexibility

03

A solution you already know, enhanced with unique features

With SwiftFinance, Microsoft Excel remains the single point of access for all the advanced features we offer.

Keep the flexible tool you love so much, while benefiting from better efficiency, security and governance for the operation of your financial processes

See how SwiftFinance

can help people like you

CFO

The Finance function is undergoing a digital transformation. Our strategy was to first optimize our existing processes with SwiftFinance , which allowed us to quickly increase efficiency and ensure the sustainability of our operations in order to adequately prepare us for the successful integration of AI into our operations.

Finance Director

Data preparation, the back-and-forth of Excel files between different stakeholders, and the reloading of data into the ERP at each stage was a complex exercise for us that required a lot of manual work. SwiftFinance helped accelerate this process by promoting better collaboration and reducing human error.

Accounting Director

We had a high staff turnover rate caused by the stress of month-end, year-end, and budgeting. With SwiftFinance, we work more efficiently, and my employees can spend more time with their families on evenings and weekends

Financial Analyst

Who would have thought that one day I would never depend on IT to produce my reports again! With SwiftFinance, I am now 100% autonomous to access and use my financial data myself, as well as all the other auxiliary data I need .

Accounting Specialist

I can do my job more easily, with fewer manual operations and much less risk of errors, especially with extra-accounting processes which are now centralized rather than leaving them scattered across several undocumented Excel files.

IT Analyst

SwiftFinance's financial analytical model and Power BI dataset allow me to more easily integrate financial information that is required for other analytical needs of the organization without worrying about managing the complexity and specificity inherent in the Finance domain.

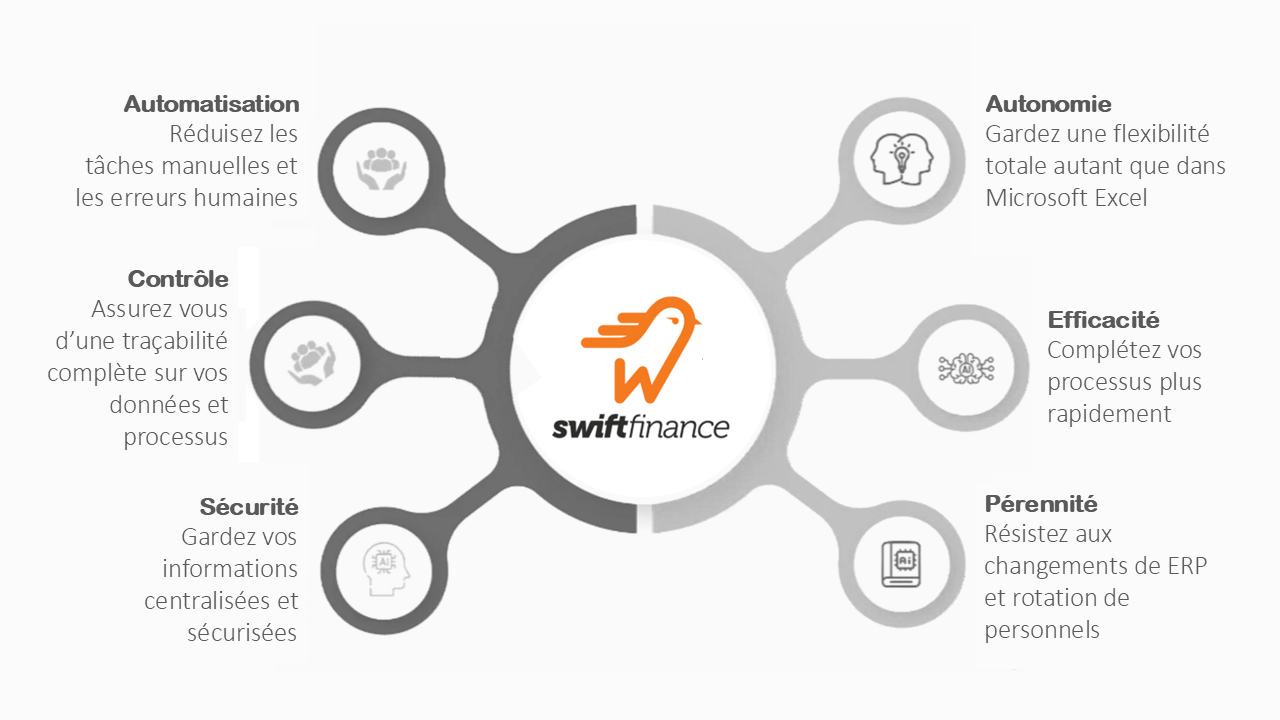

A solution with multiple organizational benefits

● Efficiency

Complete your financial processes faster

Easier financial processes , easier financial reporting, a faster budget cycle and reduced time wasted due to human error allow your team to do more with less.

● Security

Keep your sensitive data on a secure server

Centralizing your data outside of Excel files , applying rigorous governance, and tracking all activities carried out on the data help reduce the risks associated with unauthorized access to sensitive information.

● Control

Have confidence in the data you use

A centralized financial model with automated business rules, whose updates are monitored by a dedicated support team, gives your team a single version of the truth that helps ensure better reliability and integrity of the data you use.

● Autonomy

Leverage your data without relying on IT

Smart integration, directly into Microsoft Excel , of all the features needed to manage and operate financial processes in a tool you already know, allows your team to be completely autonomous in completing the tasks under their responsibility.

● Sustainability

Ensure the continuity of your internal know-how

Optimizing , simplifying and documenting the operation of financial processes helps limit the risks associated with staff turnover by reducing operational stress and additional working hours in the evenings and weekends.

● Automation

Eliminate low-value manual tasks

Reliable mechanical implementation of acquisition flows and data processing replaces repetitive, low-value-added tasks that are sources of human error, allowing your team to devote more time to analyzing and optimizing the operation of your financial processes.