Fund-based accounting presents

unexpected and complex issues

Operational complexity

Managing dozens, or even hundreds, of funds requires detailed analytical monitoring and rigorous accounting. Each fund may need to have its own budget rules, fiscal periods, and reporting requirements.

Risks of non-compliance

Manual or unsecured management of fund-specific transactions can lead to allocation errors, budget overruns, or audit issues . Because each fund has its own rules, strict execution is essential.

Difficulties in inter-departmental collaboration

Budget managers don't always have access to a common platform to collaborate on planning, leading to multiple versions of documents, delays, and inconsistencies across entities.

Fragmented data visibility

Financial data is often spread across multiple systems (ERP, Excel files, internal databases), making it difficult to have a consolidated overview of each fund. This makes producing reports or comparative analyses time-consuming and unreliable.

SEE HOW SWIFTFINANCE CAN HELP PEOPLE LIKE YOU

Accounting Director, Municipality

Ludget planning by project and fund was a coordination nightmare. With SwiftFinance, each department enters its assumptions into specialized connected applications, flows are validated automatically, and consolidation occurs in real time.

We have reduced the time needed to prepare the annual budget by 60%, while ensuring full compliance with the rules imposed by our donors.

Finance Director,

NPO,,

Before SwiftFinance, we had 45 different funding sources to track manually using disparate Excel spreadsheets. Since implementing the centralized model, we've consolidated data, enforced common governance rules, and saved significant time in our monthly closing cycle.

Our audits passed without any comments thanks to integrated traceability.

How Swiftfinance can help you to

better manage your fund accounting

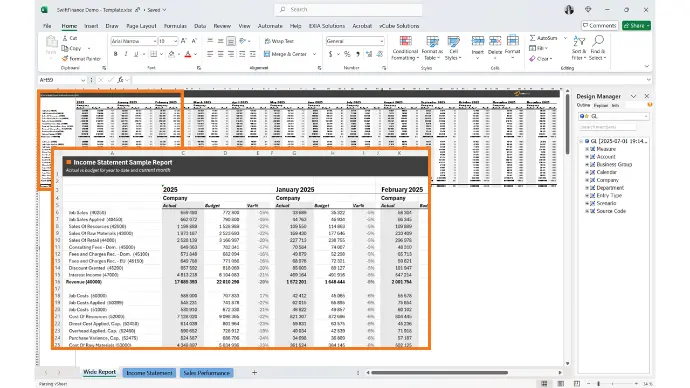

Centralized Financial Model that includes funds ⚫︎ Flexible input templates ⚫︎ Specialized Apps for managing funds ⚫︎ Financial reporting adapted for funds ⚫︎ Governance and compliance

The concept of funds is already included in the centralized analytical financial model

SwiftFinance offers a centralized financial model that already contains the concept of funds, which allows you to centralize the list of funds, their particularities and to link actual and budget transactions to them, in order to strengthen collaboration and governance.